enjoyvictory.site Market

Market

Survey That Pay Cash

Specific survey sites that pay through PayPal For those interested in taking surveys for PayPal cash, it's helpful to have a comprehensive list of reputable. Get paid by completing surveys online with Surveyz. Do the surveys in the comfort of your own home or anywhere. Paid surveys that pay more. Real money. The app that pays you real money, gift cards to do simple tasks like giving opinions, taking surveys, playing games & much more. Join Opinions For Cash and earn money by sharing your opinions on products and surveys. Get paid for your valuable insights. Start earning today! LifePoints is a premium company in the field of market surveys. It held online surveys of many known brands with new products and innovations. It offers a free. But any online paid surveys promising a large amount of cash are likely not legitimate. The lure of a big payout is simply to draw you in and get you to give up. Swagbucks, branded surveys, survey junkie they pay cash through PayPal. Made $ in a few weeks with just those 3 while I was working 2 jobs. Absolute Best Online Surveys That Pay Cash in (You Only Need 2) · B · Biofoods ; Top 5 High Paying Survey Sites · Avatar. Maureen Ward ; 52 Legitimate Survey. There are many opportunities to earn extra money and exciting rewards through legitimate online survey panels that actually pay. Specific survey sites that pay through PayPal For those interested in taking surveys for PayPal cash, it's helpful to have a comprehensive list of reputable. Get paid by completing surveys online with Surveyz. Do the surveys in the comfort of your own home or anywhere. Paid surveys that pay more. Real money. The app that pays you real money, gift cards to do simple tasks like giving opinions, taking surveys, playing games & much more. Join Opinions For Cash and earn money by sharing your opinions on products and surveys. Get paid for your valuable insights. Start earning today! LifePoints is a premium company in the field of market surveys. It held online surveys of many known brands with new products and innovations. It offers a free. But any online paid surveys promising a large amount of cash are likely not legitimate. The lure of a big payout is simply to draw you in and get you to give up. Swagbucks, branded surveys, survey junkie they pay cash through PayPal. Made $ in a few weeks with just those 3 while I was working 2 jobs. Absolute Best Online Surveys That Pay Cash in (You Only Need 2) · B · Biofoods ; Top 5 High Paying Survey Sites · Avatar. Maureen Ward ; 52 Legitimate Survey. There are many opportunities to earn extra money and exciting rewards through legitimate online survey panels that actually pay.

Want to take surveys for money? Join PaidViewpoint, a growing community of people who are eager to give their opinions in return for cash. Join InboxDollars and take surveys for money. Paid online surveys are a fun, easy way to earn extra cash online. LifePoints is a premium company in the field of market surveys. It held online surveys of many known brands with new products and innovations. It offers a free. You can earn gifts and rewards for fashion, entertainment and retail brands and you can even be paid for online surveys via our PayPal points for cash scheme or. Earn money by taking various paid surveys that will let you get payouts through gift cards and direct payouts. Here are 5 options that offer instant cash rewards you can easily transfer to your Cash App with a linked debit card or bank account. I've been taking paid surveys for years now and I know the best ways to get started making money right away even if you have never taken a paid survey. Sign up for survey websites: There are numerous websites that offer paid surveys for participants. Some popular ones include Survey Junkie. Absolute Best Online Surveys That Pay Cash in (You Only Need 2) · B · Biofoods ; Top 5 High Paying Survey Sites · Avatar. Maureen Ward ; 52 Legitimate Survey. IncomeFindr for survey money. IncomeFindr is another paid online survey company that pays cash via PayPal or with gift cards to places such as Amazon. You can. If you're only interested in platforms that allow you to start making money fast, here's a list of 15 fantastic survey sites that pay cash right away. Prolific is your best bet. It focuses on university studies, and pay quite a lot compared to commercial survey sites. Short surveys about Survey Junkie- Survey Junkie is another reputable survey website that offers a wide range of surveys. They pay in cash or gift cards, and have a. Since , Poll Pay has paid millions in cash rewards to members for doing everyday online activities like taking paid surveys or playing games. The Poll Pay. The 7 Best Paid Online Survey and Game Sites. InboxDollars · YouGov America · Freecash · Bingo Cash · Solitaire Cash · Swagbucks · Nielsen Consumer Panel. Branded Surveys then rewards you with real cash and gift cards for completing these easy tasks. In fact, we've been on the scene since and have already. Make money online by answering paid surveys. Immediately earn money for each online survey you successfully complete and get free cash or gift cards! You can earn gifts and rewards for fashion, entertainment and retail brands and you can even be paid for online surveys via our PayPal points for cash scheme or. A must-join, Ipsos iSay is probably the best-paying survey site. Its surveys are plentiful, and many folks rack up £10 or more of Amazon vouchers every month. 82% of new members earn $5 sent to their PayPal within the first day of downloading. Start earning free money today! Your first survey pays $1 in free cash.

Top Ten Investment Companies In Usa

Top Investment Management firms ; AB (AllianceBernstein). · Nashville, Tennessee ; Charles Schwab. · Westlake, Texas ; Deutsche Bank Wealth Management. PIMCO is an investment management firm providing solutions for institutions, financial professionals and millions of individuals worldwide. Learn more. JPMorgan Chase & Company is a multinational investment bank founded in and headquartered in NYC. It is the largest bank in the US and the owner of JP. companies and for our shareholders as a prudent and responsible investor Investcorp, a leading global alternative investment firm, today announced. Discover how we help individuals, families, institutions and governments raise, manage and distribute the capital they need to achieve their goals. KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure. Top 25 Mutual Funds ; 1, FXAIX · Fidelity Index Fund ; 2, VMFXX · Vanguard Federal Money Market Fund;Investor ; 3, SPAXX · Fidelity Government Money Market. According to J.D. Power, Edward Jones did particularly well in the investment adviser and investment performance factors while Fidelity did well with account. Largest companies ; 1. United States · BlackRock, United States ; 2. United States · Vanguard Group, United States ; 3. Switzerland · UBS, Switzerland ; 4. United. Top Investment Management firms ; AB (AllianceBernstein). · Nashville, Tennessee ; Charles Schwab. · Westlake, Texas ; Deutsche Bank Wealth Management. PIMCO is an investment management firm providing solutions for institutions, financial professionals and millions of individuals worldwide. Learn more. JPMorgan Chase & Company is a multinational investment bank founded in and headquartered in NYC. It is the largest bank in the US and the owner of JP. companies and for our shareholders as a prudent and responsible investor Investcorp, a leading global alternative investment firm, today announced. Discover how we help individuals, families, institutions and governments raise, manage and distribute the capital they need to achieve their goals. KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure. Top 25 Mutual Funds ; 1, FXAIX · Fidelity Index Fund ; 2, VMFXX · Vanguard Federal Money Market Fund;Investor ; 3, SPAXX · Fidelity Government Money Market. According to J.D. Power, Edward Jones did particularly well in the investment adviser and investment performance factors while Fidelity did well with account. Largest companies ; 1. United States · BlackRock, United States ; 2. United States · Vanguard Group, United States ; 3. Switzerland · UBS, Switzerland ; 4. United.

List of the largest investment companies by market capitalization, all rankings are updated daily.

With a full range of investment and planning services at their fingertips, independent financial advisors are managing more of America's wealth. Here's how. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Clients of the Firm include a global institutional investor base domiciled in North America, Europe, Asia-Pacific, Middle East and Latin America. The Investment Company Institute (ICI) is the leading association representing regulated investment funds. United States, and UCITS and similar funds. 5. BlackRock. 6. Fidelity. 7. Edward Jones. 8. TIAA. 9. Wealthfront. Investment Management Companies · BlackRock · Information Not Provided · State Street Global Advisors · Information Not Provided · Allianz Life · Information Not. Robinhood is the best/cheapest brokerage now by a significant margin. They used to suck, but they've had a few years to fix all their problems. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. 1. Fidelity. With over 40 million customers, it's no wonder Fidelity is often rated as the best overall investment firm and often cited for its low fees. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of. Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). 1. JPMorgan Chase & Co – one of the world's oldest, largest, and best known financial institutions · 2. Bank of America Corporation – the second-largest banking. Overview: Corporations sometimes raise money by issuing bonds to investors, and these can be packaged into bond funds that own bonds issued by potentially. Funds that match up with investing goals and preferences. Each investor has a different story, and we are steadfast partners to our clients in the US because we. financial professional and should be read carefully before investing. The top 10% of products in each product category receive 5 stars, the next. Top 21 Real Estate Investing Companies in the US · 1. Cushman & Wakefield · 2. Hines · 3. Re/max · 4. Highland Ventures, LTD · 5. Dominium · 6. Legacy Partners · 7. Fund - A pool of money from a group of investors in order to buy securities. The two major ways funds may be offered are (1) by companies in the securities. We create meaningful interactions between our member firms and institutional investors. We educate and empower the next generation of diverse general. Most Prestigious Banking Firms. Banking professionals across the nation rank the prestige of the firms that they compete against. Survey Methodology. KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure.

When Is Life Insurance Worth It

No – a term life policy has no cash value component. If you want a policy that provides a death benefit and builds cash value over time, you should consider. Your 20s are the best time to buy affordable term life insurance coverage. Generally, when you're younger and healthier, you pose less risk to an insurer, so. In general, it's better to buy life insurance when you're young and can lock in a low premium, because life insurance becomes more costly the older you are. But. In general, yes. Since whole life insurance lasts for the policyholder's entire life and includes a cash value component that builds over time, it usually costs. Universal life · Universal life insurance is also referred to as "flexible premium adjustable life insurance." It features a savings element (cash value) that. Cash value or permanent life insurance insures you for your lifetime. · In addition to lifelong coverage, these policies also offer a savings component—a cash. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses. Life insurance provides. Replace income for dependents. If people depend on your income, life insurance can replace that income for them if you die. · Pay final expenses. · Create an. Almost all life insurance benefits are paid out income tax-free, so it can help you pass on generational wealth. Also, permanent policies build cash value with. No – a term life policy has no cash value component. If you want a policy that provides a death benefit and builds cash value over time, you should consider. Your 20s are the best time to buy affordable term life insurance coverage. Generally, when you're younger and healthier, you pose less risk to an insurer, so. In general, it's better to buy life insurance when you're young and can lock in a low premium, because life insurance becomes more costly the older you are. But. In general, yes. Since whole life insurance lasts for the policyholder's entire life and includes a cash value component that builds over time, it usually costs. Universal life · Universal life insurance is also referred to as "flexible premium adjustable life insurance." It features a savings element (cash value) that. Cash value or permanent life insurance insures you for your lifetime. · In addition to lifelong coverage, these policies also offer a savings component—a cash. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses. Life insurance provides. Replace income for dependents. If people depend on your income, life insurance can replace that income for them if you die. · Pay final expenses. · Create an. Almost all life insurance benefits are paid out income tax-free, so it can help you pass on generational wealth. Also, permanent policies build cash value with.

In a cash value account, your cash value will grow tax-free, and you can borrow against or withdraw from it while you're alive. That makes it an attractive. These policies not only provide a death benefit but also include a cash value component that can grow over time. By purchasing a policy at a younger age, you. As you make payments, your policy will accumulate cash value. It's guaranteed to grow (typically tax-deferred) regardless of market ups and downs. You can use. Most policies let you change your premium payments, but it will affect your death benefit, cash value, or both. How long policy lasts, The period you choose. A life insurance policy's death benefit may be used to cover your small business' payroll and other operational expenses should your death disrupt operations. A life insurance policy and the associated costs may be worth it if you: Life insurance costs may not be worth it if you don't have dependents who rely on you. Senior life insurance, sometimes referred to as graded death benefit plans, provides eligible older applicants with minimal whole life coverage without a. Is converting to whole life insurance worth it? Converting to whole life insurance may not be beneficial to people who are not in a stable position. Life insurance can help pay your bills, cover debts and protect those who rely on your income through the payment of a tax-free death benefit to your. When your expenses increase, it's a good time to reassess your life insurance coverage. Why? If you passed away, your loved ones may need additional funds to. Homeowners should take out life insurance so that the death benefit can pay off the mortgage. Business owners and those who want to pass down a financial legacy. You should strongly consider converting your term life insurance into permanent coverage, especially if your insurance provider has extended you a conversion. What is a cash value life insurance policy? A cash value life insurance policy is different because you can keep it for as long as you need it. These policies. Life insurance benefits can help replace your income if you pass away. This means your beneficiaries could use the money to help cover essential expenses, such. The cash value builds over the life of the policy and is available for use. For example, a Veteran signing up at age 50 for $10, in policy coverage under. The benefits from your life insurance policy can pay down your mortgage after your death, meaning your loved ones can continue to live in the home without worry. Term life insurance benefits: With term coverage, you get short-term death benefit protection (often 10, 15, or 20 years), and your beneficiaries will receive. The employer will assist in coordinating any benefits that may be due. If you die while you are retired, your beneficiary or survivor should call Securian. Life insurance is a good idea if someone financially depends on you, like your spouse/partner, kids or aging parents. Only some Canadians need life insurance. Tax-free death benefits The beneficiary of a permanent life policy receives a guaranteed death benefit when the policyholder passes away. · Build cash value A.

Rates For Mileage

Mileage Rates ; January 1, June 30, $ ; January 1, December 31, $ ; January 1, December 31, $ ; January 1, The IRS mileage rate refers to the amount a taxpayer can deduct per mile driven for business or work-related travel. POV mileage rates (archived) ; January 1, , $ ; January 1, , $ ; January 1, , $ ; January 1, , $ These rates are based “on an annual study of the fixed and variable costs of operating an automobile,” according to the most recent news release on the subject. Rates for 67 cents per mile for business miles driven, 21 cents per mile for medical or moving purposes, 14 cents per mile driven in service of. Reimbursement rates since ; , cents/mile, $/mile ; , cents/mile · TBA. The IRS mileage rate, also known as the federal "safe harbor rate," is not the best way to deliver auto reimbursements. Why? For three glaring reasons. Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , The federal mileage rate is the amount of money an employee can deduct from their federal income taxes for the costs of operating a personal vehicle. Mileage Rates ; January 1, June 30, $ ; January 1, December 31, $ ; January 1, December 31, $ ; January 1, The IRS mileage rate refers to the amount a taxpayer can deduct per mile driven for business or work-related travel. POV mileage rates (archived) ; January 1, , $ ; January 1, , $ ; January 1, , $ ; January 1, , $ These rates are based “on an annual study of the fixed and variable costs of operating an automobile,” according to the most recent news release on the subject. Rates for 67 cents per mile for business miles driven, 21 cents per mile for medical or moving purposes, 14 cents per mile driven in service of. Reimbursement rates since ; , cents/mile, $/mile ; , cents/mile · TBA. The IRS mileage rate, also known as the federal "safe harbor rate," is not the best way to deliver auto reimbursements. Why? For three glaring reasons. Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , The federal mileage rate is the amount of money an employee can deduct from their federal income taxes for the costs of operating a personal vehicle.

Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, ,

Reimbursement Rates for Lodging, Meals, and Privately-Owned Vehicle Mileage. For the Continental USA - 48 Contiguous States and the District of Columbia. Chart of Accounts, Memos, Mileage Rates, Schedule of Expenditures of Federal Awards (SEFA), Helpful Links, Reports & Forms. Beginning on January 1, , the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be. Business mileage reimbursement rates: Moving expense and medical spending mileage reimbursement rates. CRS states that on and after January 1, , state officers and employees shall be allowed mileage reimbursement of 90% of the prevailing IRS rate. Current and Past Allowable Mileage Rates · Employee-Owned Automobiles · Privately Owned Motorcycles · Employee-Owned Automobiles Used for Move or Relocation*. What is the IRS Mileage Rate? · $ per mile for business · $ per mile for medical purposes · $ per mile for moving (used only for Armed Forces. The charity mileage rate is set by statute. Unlike the business and medical/moving rates, which can be adjusted annually by the IRS based on changes in vehicle. The standard mileage rate is the cost per mile that the Internal Revenue Service (IRS) allows for taxpayers who claim the use of a vehicle as a deductible. This article shows you, as a Certify Administrator, how to create and edit both the default and custom mileage rates and apply the rates to mileage categories. What is the current IRS mileage rate? For travel January 1, - December 31, , the IRS has increased the mileage rate to $/mi as noted here on their. Mileage Rates ; PERIOD, BUSINESS RATE, MEDICAL, RELOCATION RATE***, CHARITABLE RATE ; Jan 1, –, cents/mile, cents/mile, Not Applicable, cents/. Under the simplified method, you can use a standard rate of $ per kilometre driven for the first 5, kilometres and $ per kilometre driven after that. Standard mileage rate ; , , ; , , ; , , ; , , The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. Learn about your IRS mileage rate, and see how depreciation factors into the equation. cents per mile driven for business use, up cents from the rate for ,; 18 cents per mile driven for medical, or moving purposes. Mileage Rates Standard Mileage Rate: The mileage rate paid to persons traveling in privately owned vehicles on official business for the state. This rate is. CAD per kilometer for the first 5, kilometers driven. CAD per kilometer driven after that. Mileage rates for CAD per kilometer for the. The rate at which employees are reimbursed is set by an official body, such as the IRS in the USA or HMRC in the UK, and varies by country. The rate may also.

Does Debt Resolution Hurt Your Credit

So, each debt you settle will damage your credit score. But if your accounts are already in collections, they already count negative remarks on your credit. Debt settlement differs greatly from credit counseling and DMPs. It can be very risky and have a long-term negative impact on your credit report. Debt settlement may cause your credit score to decrease for a period of time, but it can alleviate cash flow so your budget isn't so tight. Debt settlement isn't the best option for everyone. It can hurt your credit score, and it may result in increased tax liability, as the amount of debt your. Problems with a credit card can show up on your credit report and hurt your credit history. While this will stop attempts to collect your debt, it does. Negative effect on your credit score: Debt settlement will have a negative impact on your credit report, but not as severe as bankruptcy. Tax consequences: You. Someone who is trying to limit the impact of settling debts on their credit report, but who must negotiate and fund offers one at a time, will often be looking. Debt settlement can harm your credit significantly. While negotiation is ongoing, you won't be paying your debts. All the missed payments will appear on your. There might be a negative impact on your credit report and credit score. Debt settlement programs often ask — or encourage — you to stop sending payments. So, each debt you settle will damage your credit score. But if your accounts are already in collections, they already count negative remarks on your credit. Debt settlement differs greatly from credit counseling and DMPs. It can be very risky and have a long-term negative impact on your credit report. Debt settlement may cause your credit score to decrease for a period of time, but it can alleviate cash flow so your budget isn't so tight. Debt settlement isn't the best option for everyone. It can hurt your credit score, and it may result in increased tax liability, as the amount of debt your. Problems with a credit card can show up on your credit report and hurt your credit history. While this will stop attempts to collect your debt, it does. Negative effect on your credit score: Debt settlement will have a negative impact on your credit report, but not as severe as bankruptcy. Tax consequences: You. Someone who is trying to limit the impact of settling debts on their credit report, but who must negotiate and fund offers one at a time, will often be looking. Debt settlement can harm your credit significantly. While negotiation is ongoing, you won't be paying your debts. All the missed payments will appear on your. There might be a negative impact on your credit report and credit score. Debt settlement programs often ask — or encourage — you to stop sending payments.

Debt settlement can do long-lasting damage to your credit score, affecting your ability to get a loan, a credit card, or even housing or a job in the future. Debt settlement can do long-lasting damage to your credit score, affecting your ability to get a loan, a credit card, or even housing or a job in the future. It's also important to note that while credit card debt relief may hurt your credit score in the short term, it could actually help you in the long run by. For customers of debt settlement companies, this process can eventually result in some savings, but it also will damage their credit, result in major late fees. Going through debt settlement means you didn't pay off your debts in full at the time they were due. It results in a lower credit score and reflects poorly on. Although credit scores may initially decrease while beginning debt consolidation as debt resolution, graduation from the solution generally results in an. The fact that you used a credit counseling agency to do so will not reflect negatively on your credit score. There might be an initial dip. In exchange for the. Creditors will actually not settle with you unless you make late payments. These late payments have a negative impact on your credit score. In fact, on-time. They may claim that using their services will have little or no negative impact on your ability to get credit in the future, or that any negative information. Debt settlement can harm your credit significantly. While negotiation is ongoing, you won't be paying your debts. All the missed payments will appear on your. For this reason, while a debt settlement can reduce what you owe and prevent you from using the credit card (limiting your credit expenses), you should expect. A debt settlement can however, under specific circumstances, provide a somewhat positive notation on your credit report. When debts are listed in collections it. Do Settlements Hurt Your Credit Score? Debt settlement can give you some short-term financial relief, but it can also hurt your credit score and make it. Could hurt your credit: Resolving a debt for less than what you actually owe could have a negative impact on your credit. Additionally, many debt settlement. Opting for a debt management plan usually spares significant credit score damage since monthly payments continue throughout the debt resolution process. Negative impact to your credit score: There's no way getting around it — debt settlement will ultimately hurt your credit score. That can make it difficult to. A debt settlement, with a company or creditor, will negatively impact your credit score. Payments previously made to the lender will now be paid to the. Debt settlement will affect your credit score, but not as negatively as a bankruptcy. How much can you save with debt settlement? To understand the potential. Depending on your personal situation and whether you have already missed payments to your creditors, debt settlement programs may have a negative impact on your. Debt settlement also hurts your credit score, but people's scores tend to recover more quickly and more fully after debt settlement versus bankruptcy. Higher.

How Much Does A Gold Brick Weigh

Standard 24 karat gold bar weighs kilograms or pounds. Other sizes and shapes may vary. Buying gold bars is an easy way to invest in physical gold. The average 1 Kilo (RCM) Royal Canadian Mint Gold Bar. - Weight: 1 kilo - Manufacturer. A troy ounce is equal to grams, so to work out the 1kg gold price in the US divide 1, by and multiply by the current spot price of gold. A standard gold bar weighs kilograms or pounds. While most banks use this measurement, some still store 1-kilogram bricks. As of February , that. It typically weighs in at troy ounces ( pounds), and measures 7 inches x 3 and 5/8 inches x 1 and 3/4 inches, however dimensions and weights can vary. The standard size closest to your estimate is the oz "good delivery" bar, worth about $, today. Smaller bars are also common, but no. A gold brick weighing ounces and % purity sells at about $, The price of a gold bar varies depending on various factors. They include: Purity. Given these conversions, a 1-pound gold bar would be currently worth $29, Current Gold Bar Price by Weight. Weight, Price. 1 gram, $ A good bar can be gotten for $, when measured with pounds of brick weight. This price is for a precious metal bar that weighs ounces and Standard 24 karat gold bar weighs kilograms or pounds. Other sizes and shapes may vary. Buying gold bars is an easy way to invest in physical gold. The average 1 Kilo (RCM) Royal Canadian Mint Gold Bar. - Weight: 1 kilo - Manufacturer. A troy ounce is equal to grams, so to work out the 1kg gold price in the US divide 1, by and multiply by the current spot price of gold. A standard gold bar weighs kilograms or pounds. While most banks use this measurement, some still store 1-kilogram bricks. As of February , that. It typically weighs in at troy ounces ( pounds), and measures 7 inches x 3 and 5/8 inches x 1 and 3/4 inches, however dimensions and weights can vary. The standard size closest to your estimate is the oz "good delivery" bar, worth about $, today. Smaller bars are also common, but no. A gold brick weighing ounces and % purity sells at about $, The price of a gold bar varies depending on various factors. They include: Purity. Given these conversions, a 1-pound gold bar would be currently worth $29, Current Gold Bar Price by Weight. Weight, Price. 1 gram, $ A good bar can be gotten for $, when measured with pounds of brick weight. This price is for a precious metal bar that weighs ounces and

Each typical standard gold bar weighs in as a troy-ounce Good Delivery gold bar which actually weighs lbs ( kg or ounces). A little. kilo pure 24kt gold bar. The LBMA Approved kg (oz) gold bar is brand new and has a purity of % and is therefore 24 karat gold. Please note. A gram gold bar is generally a rectangular piece of gold that weighs grams or approximately ounces produced by a bar manufacturer who conforms to. One Good Delivery gold bar weighing kilograms ( ozt). Contents. 1 Types; 2 Security features; 3 Standard bar weight units; 4 Manufacturers; 5 Largest. 1 Ounce Gold Bar: Our 1 oz gold bullion bars are made from investment grade gold bullion of at least % purity. Each one weighs exactly 1 troy ounce . That means, troy oz gold bars weigh around 27 pounds or kilograms each – about the same weight as a dumbbell. How much are these gold bars worth? To. Buying gold bars is possible in various weights from 1 gram ascending to 1 kilogram. The larger the gold bar, the lower in proportion the production costs are. g bars are traded on the. Shanghai Gold Exchange. Japan Mint. Japan. An historical oz bar. In the past, many refiners produced bars of this weight. The 'standard' for a bar of gold is actually a range of weights, averaging around ounces (troy ounces: 12 per pound). At any rate, one. The gross weight of the bar is stamped on its top face as “ozs ” (troy ounces), which is about 27 pounds. The bar on display is on loan to the Kansas City. 1 Kg Gold bar: Our 1 kilo ( troy ounces) gold bars weigh exactly 1 kg. They have a purity of between % and %. 1 kg gold bars are quickly. 1 Kg Gold bar: Our 1 kilo ( troy ounces) gold bars weigh exactly 1 kg. They have a purity of between % and %. 1 kg gold bars are quickly. Weight of Large Gold Bars. 1kg: These gold bars weigh pounds (1 liter) and are worth about $59, oz Bar: This is the standard gold bar seen in many. The weight of a one-ounce gold bar (usually written as follows: 1 oz.) is grams. It measures 47 millimetres in length, 27 millimetres in width with a. ounce bars are often referred to as Comex Good Delivery Gold Bars. Each bar weighs approximately oz. The weight can vary between 95 oz and oz (fine. Another popular option for individuals who want to purchase less than an ounce of gold is the 20 gram gold bar. It weighs troy ounces. As one of the larger. On the other hand, gold bar weights vary dramatically from about one gram to 1 kilogram, with commercial 'good delivery' bars weighing in at a huge KG. So. 10 oz gold bars are often stamped with the weight, purity, and serial number. The average weight of a 10 oz gold bar is grams or pounds. The feeling goes beyond the sheer volume of the gold bullion bar, which, by weight, is roughly equivalent to 32 one-ounce gold coins. It's a large number, but. To calculate how much a gold bar is worth, you must consider the live sell spot price for a particular weight and multiply the two values. The Royal Mint offers.

Atm Money Pass

Your Pass to Free ATMs Nationwide! Access your money at over free ATMs throughout the country. Just look for the MoneyPass symbol. UniBank has partnered with Allpoint and MoneyPass networks to bring you access to surcharge-free ATMs nationwide! MoneyPass offers several flexible options for providing MoneyPass ATM location data to your cardholders: Place a link to enjoyvictory.site on your website. The MoneyPass ATM network has thousands of locations where you live, work and travel, giving you more choices for accessing your accounts, and all are surcharge. MoneyPass® ATM Network. Using your FCB® VISA® Check Card, you now have FREE access to the MoneyPass® surcharge-free ATM Network. The MoneyPass® ATM Network. With the MoneyPass ATM Network you have access to more than 32, ATMs nationwide without a surcharge fee. This means that you can save around $2 – $3 in. With MoneyPass, cardholders can access thousands of surcharge-free ATMs at banks, credit unions, pharmacies, convenience stores, grocery stores, restaurants and. Greenleaf Wayside Bank is part of the MoneyPass® surcharge-free ATM network, and that translates into significant benefits for you. MoneyPass already has. MoneyPass network shared deposits at ATMs are available to financial institutions that participate in the Shared Deposits program. Your Pass to Free ATMs Nationwide! Access your money at over free ATMs throughout the country. Just look for the MoneyPass symbol. UniBank has partnered with Allpoint and MoneyPass networks to bring you access to surcharge-free ATMs nationwide! MoneyPass offers several flexible options for providing MoneyPass ATM location data to your cardholders: Place a link to enjoyvictory.site on your website. The MoneyPass ATM network has thousands of locations where you live, work and travel, giving you more choices for accessing your accounts, and all are surcharge. MoneyPass® ATM Network. Using your FCB® VISA® Check Card, you now have FREE access to the MoneyPass® surcharge-free ATM Network. The MoneyPass® ATM Network. With the MoneyPass ATM Network you have access to more than 32, ATMs nationwide without a surcharge fee. This means that you can save around $2 – $3 in. With MoneyPass, cardholders can access thousands of surcharge-free ATMs at banks, credit unions, pharmacies, convenience stores, grocery stores, restaurants and. Greenleaf Wayside Bank is part of the MoneyPass® surcharge-free ATM network, and that translates into significant benefits for you. MoneyPass already has. MoneyPass network shared deposits at ATMs are available to financial institutions that participate in the Shared Deposits program.

Use your UniBank debit/ATM card at over 35, ATMs without paying a surcharge. If an address has more than one ATM, be sure to look for the MoneyPass logo. MoneyPass has more than 25, ATMs nationwide. MoneyPass ATMs are only located in the United States and Puerto Rico. You can look at MoneyPass or install the. The Nonproprietary ATM Fee disclosed on the Credit Union's Fee Schedule is a transaction fee, not a surcharge fee, and will be charged on all nonproprietary. Greenleaf Wayside Bank is part of the MoneyPass® surcharge-free ATM network, and that translates into significant benefits for you. MoneyPass already has. So go ahead, use your R Bank ATM or debit card now at all ATM's listed on the MoneyPass® ATM locator site and your transactions will be surcharge-free. MoneyPass® ATM Network. You can use your TFCU Debit Card at any MoneyPass® ATM surcharge free! FirstBank is now part of the MoneyPass ATM Network giving our debit cardholders access to + surcharge-free ATMs nationwide. MoneyPass is an ATM network that allows customers to access nearly 40, convenient surcharge-free ATMs nationwide. How does MoneyPass work? Click the “Find. Starion Bank partnered with MoneyPass to bring you surcharge-free access to more than ATMs across the country. Find one online or download our app. ATM Locations. MoneyPass® offers more ATM locations in our area, providing more convenient access for our customers. Just look for the MoneyPass® logo or use. With more than surcharge-free ATMs nationwide, Tri Counties Bank is committed to providing Service With Solutions anywhere. MoneyPass provides surcharge-free ATM services to North American MoneyPass consumer/cardholders whose transactions utilize a MoneyPass supported ATM and has. Access to your money is closer than you think! All Home Bank of California debit cards come with surcharge-free, nationwide access to MoneyPass ATMs. The MoneyPass ATM Network offers over 32, surcharge-free ATMs located throughout the United States that you can use fee-free. What is an ATM Surcharge Fee? A. As a member of the MoneyPass fee-free ATMs, Peoples Bank debit card customers have access to over 35, ATMs nationwide for cash withdrawals without a. As a valued customer of First State Bank Nebraska, you have the benefits of a nationwide ATM network available to you with MoneyPass®. This powerful network. As a Capital One checking customer, you can get money from 70,+ fee-free Capital One, MoneyPass® and Allpoint® ATMs—including in select Target®. Our Surcharge-free ATM option through MoneyPass® 1 delivers access to approximately 40, MoneyPass ATMs across the U.S., which means you can build cardholder. MoneyPass has more than 25, ATMs nationwide. MoneyPass ATMs are only located in the United States and Puerto Rico. You can look at MoneyPass or install the.

Pay Half Credit Card Bill

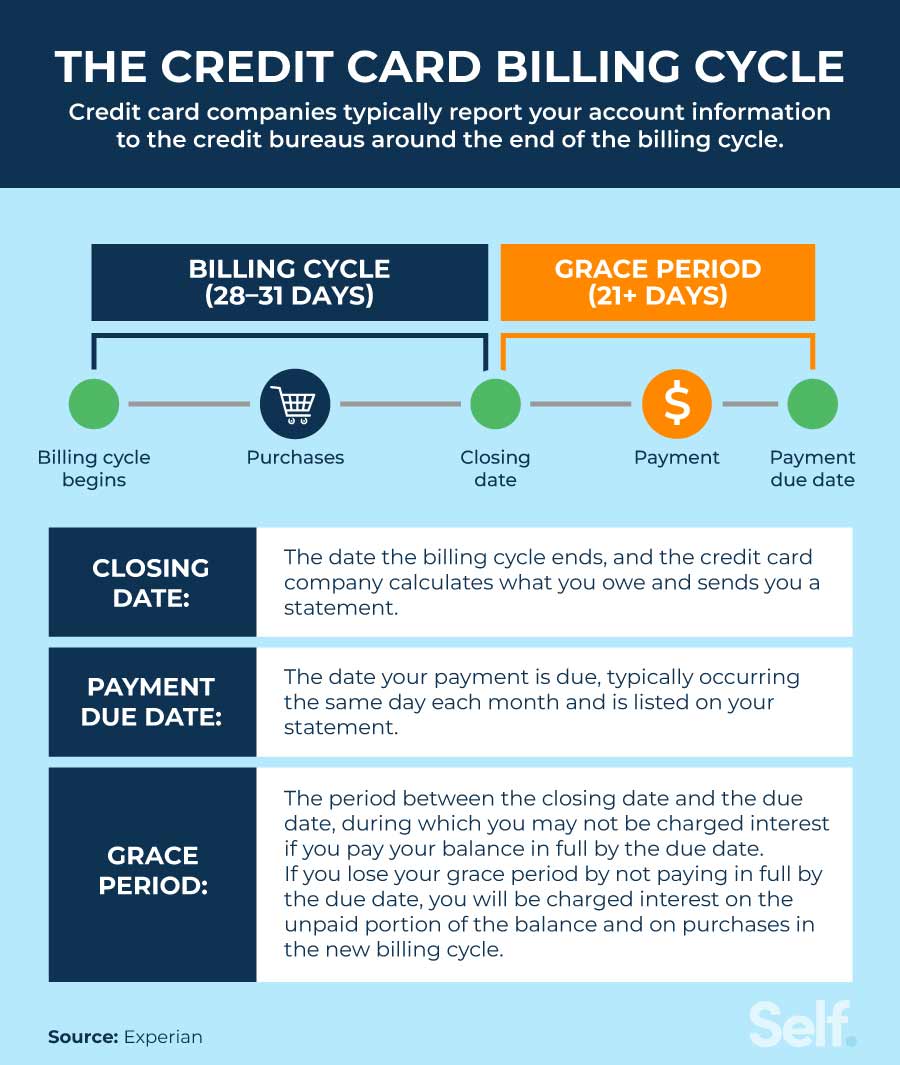

At the end of each monthly billing cycle, the card issuer will tell you how much you owe, the minimum payment it requires from you, and when that payment is. As a result, credit card debt can slowly take over your budget. Minimum payments eat up all your free cash flow and leave you struggling to cover daily expenses. If you make a half payment on the 15th it will reduce your average daily balance, lowering the interest charged when the cycle ends. China UnionPay (credit card only); Visa, MasterCard, or American Express prepaid credit or gift cards. You can add a completely new payment card or change. Paying half your credit card bill will be fine (other than paying some interest). But make sure you mean half of your credit card balance. If you can't pay the whole balance off, you'll usually have to pay at least a minimum payment. You can check your credit card statement to find out how much. If you make an early payment before your billing cycle ends, you may be able to reduce your interest charges, even if you don't pay off your entire balance. In. You can now pay your credit card bill through the regular payments section in your Google Pay app. Link your credit card to Google Pay Open Google Pay. In these situations — and any time you have a higher-than-normal balance — it can be a good idea to make multiple payments during your billing cycle or simply. At the end of each monthly billing cycle, the card issuer will tell you how much you owe, the minimum payment it requires from you, and when that payment is. As a result, credit card debt can slowly take over your budget. Minimum payments eat up all your free cash flow and leave you struggling to cover daily expenses. If you make a half payment on the 15th it will reduce your average daily balance, lowering the interest charged when the cycle ends. China UnionPay (credit card only); Visa, MasterCard, or American Express prepaid credit or gift cards. You can add a completely new payment card or change. Paying half your credit card bill will be fine (other than paying some interest). But make sure you mean half of your credit card balance. If you can't pay the whole balance off, you'll usually have to pay at least a minimum payment. You can check your credit card statement to find out how much. If you make an early payment before your billing cycle ends, you may be able to reduce your interest charges, even if you don't pay off your entire balance. In. You can now pay your credit card bill through the regular payments section in your Google Pay app. Link your credit card to Google Pay Open Google Pay. In these situations — and any time you have a higher-than-normal balance — it can be a good idea to make multiple payments during your billing cycle or simply.

Ideally, you should be paying off your credit card balances every month for one major reason – to avoid the credit card interest rate on any outstanding balance. pay their credit card bills late and more. How much credit card debt do Fewer than half of adult credit cardholders (47%) carried a balance on a. To make or schedule a single online payment, sign in to Account Manager and press "Make a Payment" under the Payments tab. Our Sam's Club warehouse locations do accept split payments with multiple credit/debit cards and payment methods. For smaller balances, you'll probably need to pay the flat payment but larger card balances will have significantly higher minimum payments. A $10, credit. You make one payment 15 days before your statement is due and another payment three days before the due date. Before you begin · A split tender payment isn't complete until there's no remaining balance. The entire amount of the sale must be processed. · If a split tender. There is a smaller amount you can pay called the Minimum Payment Amount. Now this amount you need to pay by the payment due date. Paying your Minimum Payment. We have options to pay your account whether you are a Canadian or International student. See below for more details. placeholder - card module Pay a bill; The. pay their credit card bills late and more. How much credit card debt do Fewer than half of adult credit cardholders (47%) carried a balance on a. It's a good idea to pay off your credit card balance in full whenever you're able. · Carrying a monthly credit card balance can cost you in interest and increase. You're typically advised to make more than the minimum payment to help you pay off your balance faster and to reduce your credit utilization ratio, as well as. Higher interest rates aren't just a future problem. The credit card company is likely to raise the interest rate on your account. It can do that after two. Need to make a payment? Learn how and when to make payments on your Navy Federal credit card here. Interest rates are typically between 25% and 60%, so this can be expensive. Late payments damage your credit rating. If you pay late or less than the minimum, a. Yes, you can make partial as well as excess payment for your credit card bill. Although not paying the due-amount in full before the last date of payment. Interest rates are typically between 25% and 60%, so this can be expensive. Late payments damage your credit rating. If you pay late or less than the minimum, a. Paying only the minimum payment may help keep your account in good standing, even if you carry a revolving balance. It also typically means you won't have to. The 15/3 strategy claims you can help your credit score dramatically by making half your credit card payment 15 days before your account statement due date and. Making the minimum payment on a credit card can be a recipe for never-ending debt. That's because even if you pay enough to avoid late fees, you'll still be.

Eur Usd Price Live

Live EUR/USD Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; Today's High: ; Today's Low: ; Previous day's Close: Live chart for EURUSD. View market trends using popular technical indicators and drawing tools, and analyse price history using chart types such as Renko. EUR/USD - Euro US Dollar ; Prev. Close: ; Bid: ; Day's Range: ; Open: ; Ask: Convert Euro to US Dollar ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 25 EUR, USD. CCY - Delayed Quote • USD. EUR/USD (EURUSD=X). Follow. + (+%). At close: September 13 at PM GMT+1. 1D. 5D. %. 3M. %. See what's happening in real-time to the EUR/USD (EURUSD) stock price and gain some insight on the company's history and their future from FXCM. Current exchange rate EURO (EUR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Get instant access to a free live streaming EUR USD chart. This unique Euro Live Currency Cross Rates · Exchange Rates Table · US Dollar Index Futures. Get EUR/USD (EUR=:Exchange) real-time stock quotes, news, price and financial information from CNBC. Live EUR/USD Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; Today's High: ; Today's Low: ; Previous day's Close: Live chart for EURUSD. View market trends using popular technical indicators and drawing tools, and analyse price history using chart types such as Renko. EUR/USD - Euro US Dollar ; Prev. Close: ; Bid: ; Day's Range: ; Open: ; Ask: Convert Euro to US Dollar ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 25 EUR, USD. CCY - Delayed Quote • USD. EUR/USD (EURUSD=X). Follow. + (+%). At close: September 13 at PM GMT+1. 1D. 5D. %. 3M. %. See what's happening in real-time to the EUR/USD (EURUSD) stock price and gain some insight on the company's history and their future from FXCM. Current exchange rate EURO (EUR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Get instant access to a free live streaming EUR USD chart. This unique Euro Live Currency Cross Rates · Exchange Rates Table · US Dollar Index Futures. Get EUR/USD (EUR=:Exchange) real-time stock quotes, news, price and financial information from CNBC.

EUR to USD currency chart. XE's free live currency conversion chart for Euro to US Dollar allows you to pair exchange rate history for up to 10 years. See the latest price data and market sentiment for the euro against the US dollar and spot trading opportunities. EUR/USD is one of the major forex pair. Euro to Dollar Chart and Prices Today This page includes full information about the EUR/USD, including the Euro to Dollar live chart and dynamics on the chart. The current rate of EURUSD is USD — it has decreased by −% in the past 24 hours. See more of EURUSD rate dynamics on the detailed chart. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast. EUR/USD - Euro US Dollar ; Prev. Close: ; Bid: ; Day's Range: ; Open: ; Ask: The EURUSD decreased or % to on Tuesday September 3 from in the previous trading session. Euro US Dollar Exchange Rate - EUR/USD. EURUSD Euro US DollarCurrency Exchange Rate Live Price Chart ; EURUSD, , , % ; EURGBP, , , %. Get free real-time information on EUR/USD quotes including EUR/USD live chart Euro - United States Dollar - Price. Euro - United States Dollar (EUR - USD). View live Euro - US Dollar chart to track the latest price changes. EUR/USD price chart, real-time data, and historical trends for informed decisions. The rate of EURUSD (EURUSD) currency pair for today is $ The highest cost of EURUSD (EURUSD) for today was $, the lowest rate was $N/A. The. EUR/USD pricing and leverage information. View trading opportunities for EUR/USD. Trade Euro / United States dollar price movements with Spot FX. Live Euro / US dollar chart. Plus all major currency pairs, realtime Euro vs USD (EURUSD) chart example with Time axis and Price axis. What time. EURUSD | A complete Euro currency overview by MarketWatch. View the currency market news and exchange rates to see currency strength. EUR/USD (EURUSD=X) ; Aug 20, , , , , ; Aug 19, , , , , EUR/USD exchange rate. Charts, forecast poll, current trading positions and technical analysis. Keep informed on EUR/USD updates. Browse our live EUR/USD chart to get all the information you need on EUR/USD currency pair price today. Find EUR/USD price predictions, trends, and price. Euro/U.S. Dollar (^EURUSD) · Euro/U.S. Dollar Futures Market News and Commentary · Commitment of Traders Positions as of Aug 27, · Price Performance · Most. EUR/USD could face immediate support at (Fibonacci % retracement of the latest uptrend) ahead of (psychological level, Fibonacci 50%. Discover Live streaming EUR/USD forex chart ✅️. Get free real-time information about EUR/USD Exchange Rate ✅️ Current Rate ✓ Historical data ✅️ and more.

Low Cost Car Insurance In Georgia

Peachstate Insurance is an independent agency offering collision, medical and uninsured motorist coverages to residents of Atlanta, Georgia. Georgia car insurance discounts It's possible to get quality coverage at a lower rate than you might think. When you get a quote for Georgia auto insurance. Auto-Owners Insurance has the cheapest car insurance rates in Georgia, on average. Its average annual rate of $1, is $ per year less expensive than the. How much is car insurance in Georgia? Georgia drivers pay an average rate of $ annually for state-mandated minimum coverage. Full coverage, which includes. Discover the Georgia Car Insurance requirements and discount opportunities. Get a free Georgia Car Insurance quote today from Farmers Insurance. Browse for the best car insurance policies in Atlanta, GA. Compare quotes from the top 52 car insurance companies in Atlanta, Georgia. Looking for cheap car insurance in Georgia? Freeway Insurance walks you through finding affordable auto insurance, plus discounts. 1. Mile Auto. Mile Auto offers per-mile insurance, so the less you drive, the lower your auto insurance rates will be. This benefits drivers who travel short. Bankrate's analysis found that Mercury, Auto-Owners and Allstate offer some of the lowest rates for car insurance in Georgia. Peachstate Insurance is an independent agency offering collision, medical and uninsured motorist coverages to residents of Atlanta, Georgia. Georgia car insurance discounts It's possible to get quality coverage at a lower rate than you might think. When you get a quote for Georgia auto insurance. Auto-Owners Insurance has the cheapest car insurance rates in Georgia, on average. Its average annual rate of $1, is $ per year less expensive than the. How much is car insurance in Georgia? Georgia drivers pay an average rate of $ annually for state-mandated minimum coverage. Full coverage, which includes. Discover the Georgia Car Insurance requirements and discount opportunities. Get a free Georgia Car Insurance quote today from Farmers Insurance. Browse for the best car insurance policies in Atlanta, GA. Compare quotes from the top 52 car insurance companies in Atlanta, Georgia. Looking for cheap car insurance in Georgia? Freeway Insurance walks you through finding affordable auto insurance, plus discounts. 1. Mile Auto. Mile Auto offers per-mile insurance, so the less you drive, the lower your auto insurance rates will be. This benefits drivers who travel short. Bankrate's analysis found that Mercury, Auto-Owners and Allstate offer some of the lowest rates for car insurance in Georgia.

From Atlanta to Columbus and Augusta to Savannah, safe drivers in Georgia can get affordable car insurance with Root. Download our mobile app today to start. After thorough research and a great deal of analysis, I have determined that State Farm Insurance is the cheapest car insurance for low-income drivers in. People purchase auto insurance to protect themselves and their families against costs associated with vehicle-related accidents and incidents. Discover the best and cheapest car insurance in Georgia with rates starting at $24/month as Geico being the top pick for affordable coverage. Discover the most affordable car insurance quotes in Georgia with Velox Insurance. Easily compare the lowest rates and purchase your policy online today. Freedom National offers fiercely competitive, rock bottom rates - many drivers find we offer the cheapest car insurance in Georgia! Drivers can find the cheapest rates in Georgia with State Farm and COUNTRY Financial, which have monthly liability rates as low as $64 and $65, respectively. Get a free Georgia car insurance quote today. Nationwide offers personalized coverage options, discounts, and auto insurance you can rely on. How much is car insurance in Georgia? Georgia drivers pay an average rate of $ annually for state-mandated minimum coverage. Full coverage, which includes. Direct Auto specializes in helping people find affordable car insurance coverage, regardless of their history. Give us a call today for a free quote. Finding cheap car insurance in Georgia has never been simpler. Give us a call at , check us out online for a quick quote or stop by one of our. The price is dependent on your driving, your credit, your neighborhood. No one can answer this unless they work for an insurance company. COUNTRY Financial provides the cheapest minimum coverage auto insurance in Georgia, averaging $ annually. Enter your ZIP code to get started. Country Financial is the cheapest car insurance company in Georgia overall, with an average rate of $45 per month for minimum coverage and $ per month for. Cheapest Car Insurance in Georgia for Young Drivers ; Country Financial · $97 per month ; Auto-Owners · $ per month ; Geico · $ per month ; State Farm · $ per. Georgia law requires drivers to maintain minimum amounts of auto liability insurance, but finding affordable coverage can be challenging. We found that Country Financial offers the cheapest annual rate at $ in Georgia. The most expensive annual auto insurance rates are for State Farm which is. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Lowest Rates Guaranteed: We specialize in finding you the most affordable auto insurance rates in Georgia. Our goal is to save you money without compromising on.